Despite growing competition from vertically integrated firms in the building construction and engineering consulting industries, the architectural services sector is projected to grow over the next five years to reach $7.1 billion in annual revenue.

This forecast of an annualised 2.2 per cent growth from 2015 to 2020 comes after an IBISWorld Architectural Services in Australia industry report released last year, showing that clients are being attracted towards more integrated service offerings, such as those provided by engineering firms with in-house design capabilities.

It is suggested architecture firms will therefore need to improve links with constructions firms or even offer their own range of similar services to compete, although report author Sebastian Chia said the nature of the industry, which has a fragmented structure with few large-scale national players and many small-scale firms that operate in narrow regional markets, would make this move difficult.

However, in a recent update to the report, Chia predicts that improved investment in the commercial and residential building markets will strengthen demand conditions for architecture and design firms despite the growing competition.

“The Architectural Services industry is expected to recover over the next few years, in line with improved investment trends in the commercial building and housing markets,” says Chia.

“The Architectural Services industry is expected to recover over the next few years, in line with improved investment trends in the commercial building and housing markets,” says Chia.

“Heightened competitive conditions are likely to prevail at the top end of the design market, as local players vie for market share against large-scale, multidisciplined engineering companies and global architectural firms, such as US-based Gensler, which opened its first Australian office in January 2013.

“However, the make-up of the industry is unlikely to change significantly and will remain structured around a few large firms, along with many small-scale companies and some sole proprietors.”

He suggests the formation of strategic alliances between larger firms to help them bid for larger projects, and adds that improved demand conditions in the commercial building and apartment markets will allow for some widening of industry profit margins.

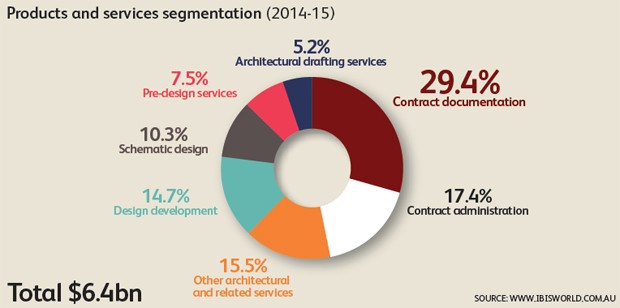

In 2014-15, the industry is forecast to generate revenue of $6.4 billion, rising 2.0 per cent from the previous year. Rising investment is expected in the single- and multi-unit housing sectors because of record low interest rates and an expected recovery in economic growth.

Building market outlook, according to IBISWorld:

“The industry derives the majority of its revenue from work in the non-residential building market, which is forecast to recover following the winding back of public spending on institutional building construction. While investment into the non-residential building market is expected to be weak over 2014-15, growth is expected to increase from 2015-16, as commercial and industrial building construction heats up. Large retail, office and entertainment developments are expected to contribute to demand over the period. The institutional building market is also expected to rebound over the period, with growth in the healthcare sector expected to drive most of the gains.

"The industry is forecast to record revenue growth of 1.3 per cent during 2015-16, mainly due to slowing demand from the housing market. The residential construction market is expected to slow over the next five years as recent additions to stock in the multi-unit apartments and townhouse market reach saturation. While the single-unit housing market is also expected to grow slowly due to deteriorating affordability, this market tends to have less need for architectural design during construction.”

Demand from commercial and industrial building construction

Demand from commercial and industrial building construction is expected to rebound over 2014-15, even though a slump in commercial building construction over the last five years had an adverse effect on demand for architectural services.

“The construction of commercial and industrial buildings (such as offices, hotels, shopping centres, factories and sporting venues) represents an integral market for architects,” says Chia, noting that industry revenue and profitability will be heavily influenced by investment trends into non-residential buildings.

Demand from institutional building construction

The construction of schools, hospitals, prisons and other institutional projects represents an important source of demand for architects:

“Investment into institutional buildings is influenced by general trends in the economy along with public sector expenditure programs. Demand from institutional building construction is expected to show slow growth over 2014-15, which may pose a threat to industry growth.”

Demand from house construction

The industry continues to rely on demand from residential construction, particularly high-value projects and major alterations and additions to existing houses.

“New residential construction accounts for a significant share of industry revenue. However, subdued housing investment over the past five years has weakened demand for architectural design services. Demand from house construction is expected to rise in 2014-15,” says Chia.

Capital expenditure on private dwellings is also expected to rise over the coming year, presenting more opportunities for the industry.

The full report can be purchased HERE