The recent ABS release of housing data includes crucial information regarding dwelling commencements, with the update coming in largely as expected, said the Housing Industry Association (HIA).

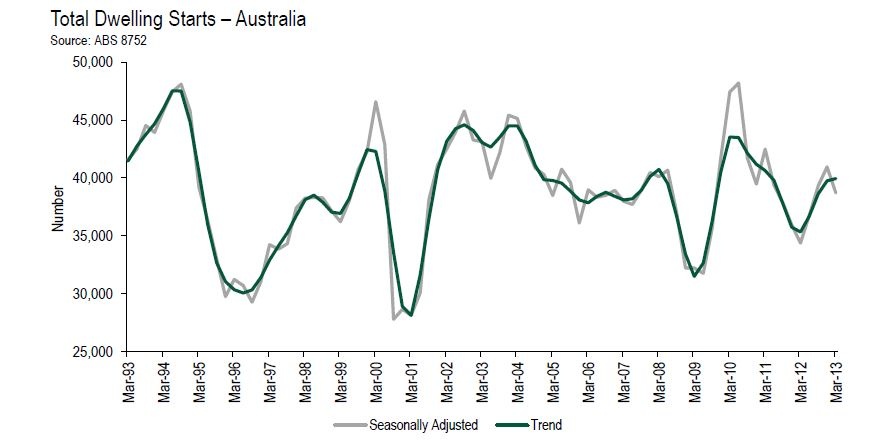

"Dwelling commencements fell in the March 2013 quarter and the ABS's upward revisions to the 2009 - 2012 period are significant, both of which were anticipated results," said HIA Chief Economist, Dr Harley Dale.

"Even allowing for a higher GFC stimulus-induced peak in 2010, the subsequent drop in dwelling commencements (housing starts) over 2011 and 2012 remains significant," said Mr Dale.

"The further decline of 5.5 per cent in dwelling commencements in the March 2013 quarter reinforces how much work lies ahead to ensure a new home building recovery is both sustainable and of a magnitude that reflects Australia's housing and wider economic needs."

"The number of dwelling commencements fell in five out of six states in the first quarter of 2013, while a flat result was recorded for New South Wales. On a six month annualised basis, dwelling commencements continue to track well below the housing requirements of the population in New South Wales, Queensland, South Australia, Western Australia, and the Northern Territory."

"Granted, the lagged impact of lower interest rates combined with the competitive nature of the new home building sector should deliver some recovery in new home starts in mid-2013. However, any such improvement will be of insufficient strength and steam if policy makers continue to presume lower interest rates and a redirection of first home buyer assistance is all the action that is required," noted Harley Dale.

The ABS release also included an update revealing on-going weakness in activity for larger alterations and additions.

According to the release, the volume of major Alterations & Additions declined by 5.5 per cent in the first quarter of 2013 compared with the previous quarter and was 9.9 per cent lower than in the same quarter of 2012.

These latest reductions in activity are in line with the persistent falls in renovations activity over recent years. The volume of major renovation activity has fallen some 17 per cent since its peak in mid-2011 and soft conditions are likely to prevail throughout 2013.