Industry analyst and economic forecaster, BIS Shrapnel, says the shift to apartment living could slow over the next decade, as the 20-to-34 year olds – who have driven apartment occupancy over the last 10 years – begin to move into their next stage in life.

According to the company’s Emerging Trends in Residential Market Demand report, which examines trends revealed by a detailed analysis of Census data from the last 20 years, the increasing propensity to live in multi-unit dwellings will continue to drive solid demand for units and apartments over the next decade, but the overall movement to apartments will stabilise.

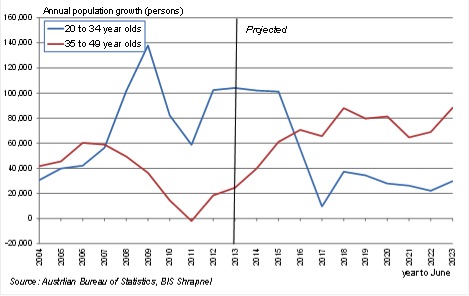

Senior Manager, Mr Angie Zigomanis, noted that 20-to-34 year olds have accounted for an increased share of population growth over the past decade, reflecting both the children of the Baby Boomer generation moving into this age group, as well as the age profile of Australia’s higher overseas migration in this period.

Chart: Annual population growth 20-to-34 year olds and 35-to-49 year olds

Chart: Annual population growth 20-to-34 year olds and 35-to-49 year olds

“The growth in the 20-to-34 year old group has fuelled occupancy of units and apartments in the inner and middle suburbs of the capital cities over the past decade, mainly as renters,” says Zigomanis.

“Assuming the current 20-to-34 year olds in multi unit dwellings move on to separate houses, as has already been evident among 35-to-49 year old households, then this will translate to higher demand for new detached houses,” says Zigomanis.

“This would provide some relief for land developers, builders and building materials suppliers who mainly service the detached house market and have found the going tough in recent years – although the challenge will be for all stakeholders to ensure that the greenfield land market will be able to meet this potential increase in demand.”

However, Zigomanis also points to an alternate scenario, suggesting Generation Y apartment dwellers would stay in medium and high density units because of location, lifestyle and affordability.

“This scenario provides an opportunity for developers to meet demand for a different type of multi-unit dwelling to the typical investment stock that is currently being built in established areas to accommodate the younger 20-to-34 year old renters,” says Zigomanis.

“It could also trigger greater renovation activity as the emerging 35-to-49 year olds who still want a house purchase in established areas and tailor the house to their needs.”

Meanwhile, analysis of Census data does not yet reveal any major evidence of an increase in the rate of downsizing among retirees aged 65 and above.

However, this could change in the future, with an increasing number of 50-to-64 year olds likely to sell out of their dwelling upon retirement to move elsewhere or into a lower priced smaller dwelling to reduce their mortage debt.

If this is the case, the houses they sell may provide a market for 35-to-49 year olds to move into, and relieve some of the pressure on new house construction in the outer suburbs from this group.